Pastor Your People. Avoid Payroll Perils.

Article from When Outdated Bylaws Backfire, an edition of our risk management magazine, Resilient Ministry.

10 min read

When Pastor Jay was hired to lead at a new church, he didn’t realize being in charge of payroll would become one of his “other duties as assigned.” They didn’t teach how to process payroll in seminary.

Even for churches blessed with a CPA or tax specialist, payroll involving clergy can be tricky. “We see this a lot,” said Tonya Miller, a manager with Brotherhood Works. “It seems like doing payroll for two or three staff should be easy, but when one is clergy, you run into a whole different set of rules. Our payroll specialists help clients daily with questions about everything from ministerial housing allowances to a clergy’s tax status, and other nuances unique to Christian employers.”

What Could Go Wrong?

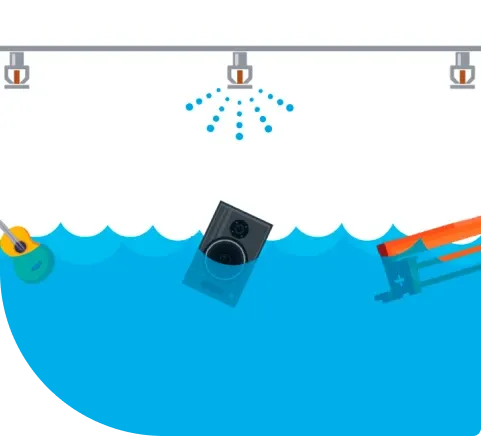

One of the consequences of getting payroll wrong is that ministry employees can be held personally accountable by the IRS for incorrectly filing payroll taxes, leaving individuals responsible for paying penalties out of pocket. Another issue that ministries often run into is determining who qualifies for a housing allowance. Miller shared some of the costly scenarios her staff have seen as they’ve worked with new clients:

A church bookkeeper, unaware that 941s had been mishandled, was personally fined $4,000 by the IRS for filing quarterly tax returns incorrectly.

One volunteer church treasurer had incorrectly filed and processed the church’s tax withholdings and payments for 10 years, including FICA taxes for their pastor, resulting in $13,000 due in back taxes and penalties.

Church administrators were unaware that by withholding FICA taxes for their pastor, the IRS would consider the pastor a regular employee for tax purposes. As a result, the pastor was no longer eligible for a taxfree housing allowance.

A charitable organization, run by a church, withheld income and FICA taxes from employees’ paychecks but failed to remit the taxes to the IRS. Four officers were ordered to pay more than $200,000 in unpaid taxes because it was their duty to collect and pay the taxes.

Helping ministries solve payroll issues like these is part of why Brotherhood Works was created by the team at Brotherhood Mutual.* “The leadership at Brotherhood Mutual are really focused on providing as many tools as possible to keep ministries thriving. When they see a way to help, they do, even if that means creating a whole new company entirely focused on ministry payroll and tax services,” said Miller. “And in keeping with that spirit, as we’ve grown to serve more than 7,000 ministries, we’ve expanded into HR solutions, such as time and attendance, healthcare reporting, and talent management and onboarding modules.”

Vetting Payroll Service Providers

"It’s good risk management to work with someone experienced in payroll, and even better risk management to work with a company that knows ministry payroll inside and out,” said Miller.

When choosing a payroll provider, here are some things to consider:

How many ministries do you work with?

How does your call center work?

Will we have our own payroll specialist?

What other tools do you offer along with payroll?

What steps will you take to protect my ministry’s information?

What is your onboarding process like?

How do you catch up on our payroll history?

Choosing the right company means you can rely on a payroll specialist who becomes an effective extension of your ministry’s payroll or HR team. That’s one less hat for you to wear, so you can focus on living out your mission, rather than worrying about the administrative burdens of payroll.

For more information about Brotherhood Works, visit brotherhoodworks.com.